utah state tax commission ogden

Please allow three working days for a. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Utah Income Taxes Utah State Tax Commission

Motor Vehicles Watercraft.

. You will need to provide information from the Check your refund status page. It does not contain all tax laws or rules. For security reasons Taxpayer Access Point is not available in most countries outside the United States.

The Utah State Tax Commission created in 1931 consists of four members not more than two of whom may belong to the same political party. For security reasons TAP and other e-services are not available in most countries outside the United States. Reviews from Utah State Tax Commission employees about Utah State Tax Commission culture salaries benefits work-life balance management job security and more.

Utah State Tax Commission can be contacted via phone at. Be Postmarked on or before November 30 2021 by the United States Postal Service or. The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax Commission.

If you need an accommodation under the Americans with Disabilities Act email taxadautahgov or call 801-297-3811 or Telecommunication Device for the Deaf TDD 801-297-2020. Overall taxpayers in Utah face a relatively low state and local tax burden. File electronically using Taxpayer Access Point at taputahgov.

2380 washington blvd suite 350. Verify refund mailing address on your return was correct. 801 626-3460 Visit Website Map Directions 2540 Washington BlvdOgden UT 84401 Write a Review.

Utah State Tax Commission Attn. For security reasons TAP and other e-services are not available in most countries outside the United States. The county sales tax rate is.

Filing extensions and tax relief programs. Utah State Tax Commission can be contacted at 801 626-3460. If you need an accommodation under the Americans with Disabilities Act you may emailtaxadautahgov or call 801-297- 3811 or call our Telecommunication Device for the Deaf TDD at 801-297.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. We have an immediate opening for a Fund Accountant Tax in either our Salt Lake City or Ogden Utah offices. The state of Utah has a single personal income tax with a flat rate of 495.

Please allow three working days for a response. Reviews from Utah State Tax Commission employees in Ogden UT about Pay Benefits. Master File 210 North 1950 West Salt Lake City UT 84134-3310 Fax.

Taxes are Delinquent if paid after November 30 2021. Utah State Tax Commission is located at 2540 S Washington Blvd Ogden UT 84401. Different requirements fees and taxes apply depending on your vehicle type and other factors.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Consult the menu at left for an overview of the Utah vehicle registration process. Utah State Tax Commission in the city Ogden by the address 2540 S Washington Blvd Ogden UT 84401 United States.

Homeowners in Utah also pay exceptionally low property taxes with an average effective rate of just 058. For security reasons TAP and other e-services are not available in most countries outside the United States. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. See reviews photos directions phone numbers and more for Utah State Tax Commission locations in Ogden UT. Wait 30 days from the refund issue date then contact the Utah Department of Finance at 801-957-7760.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. On November 30 or. Sales taxes in Utah range from 610 to 905 depending on local rates.

It does not contain all tax laws or rules. The utah state tax commission commission may require vehicles operating on clean fuels to be inspected for safe operation. Contact us by phone click on the Phone tab above for numbers.

As a Fund Accountant Tax you will utilize your communication and organizational skills to complete the preparation and filing of tax returns for our clients. UTAH STATE TAX COMMISSION MEETING AGENDA 830am Thursday December 2nd 2021 Via Zoom Ogden Eccles Conference Center 2415 Washington Blvd. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

It does not contain all tax laws or rules. Get Utah State Tax Commission reviews ratings business hours phone numbers and directions. Weber County property taxes must be brought in to our office by 5 pm.

These are the payment deadlines. This website is provided for general guidance only. Utah State Tax Commission is located at 2540 S Washington Blvd in Ogden Utah 84401.

Most on- and off-road vehicles boats aircraft and commercial vehicles must be registered to operate in Utah. Weber center 2380 washington blvd ogden utah 84401. Address changes for your vehicle or watercraft can be done online using the Manage Your Vehicles option in Utahs Motor Vehicle Portal.

The Governor with consent of the Senate appoints members to four-year terms. Verify direct deposit information was correct. Registering Your Vehicles in Utah.

Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0260. Utah law requires Commissioners represent composite skills in accounting law auditing property assessment management and finance.

Susan Waters Legal Secretary Utah State Tax Commission Linkedin

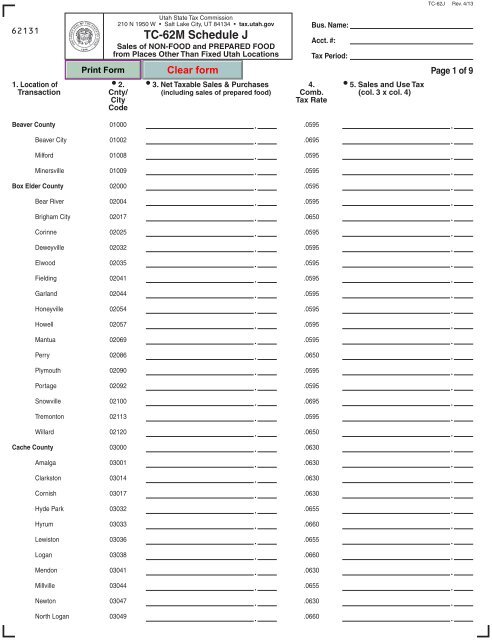

Tc 62m Schedule J Utah State Tax Commission Utah Gov

Pub 10 Utah Telephone Directory For Tax Practitioners

44 Salaries At Utah State Tax Commission Shared By Employees Glassdoor

Utah Property Taxes Utah State Tax Commission

Tc 62q Utah State Tax Commission Utah Gov

Craig Sandberg Director Utah State Tax Commission Linkedin

Utah State Tax Commission Official Website

Tc 40 Instructions Utah State Tax Commission Utah Gov

Doing Business In Utah Utah State Tax Commission Utah Gov

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties